Car Loan Process Malaysia

- If its RM65000 - an approved loan is RM59900. When buying a new car in Malaysia youll need to follow a few key steps.

Mygov Managing Finance And Taxation Getting A Loan Financing Getting A Home Loan General Rules Requirements Eligibility Amount Of Public Sector Home Financing

1 Buyer choose model 2 Contact car seller arrange for appoinment 3 Ready all required documents 4 Appointment with consultant at your door step 5 Documents submitted for loan processing 1 2 working days.

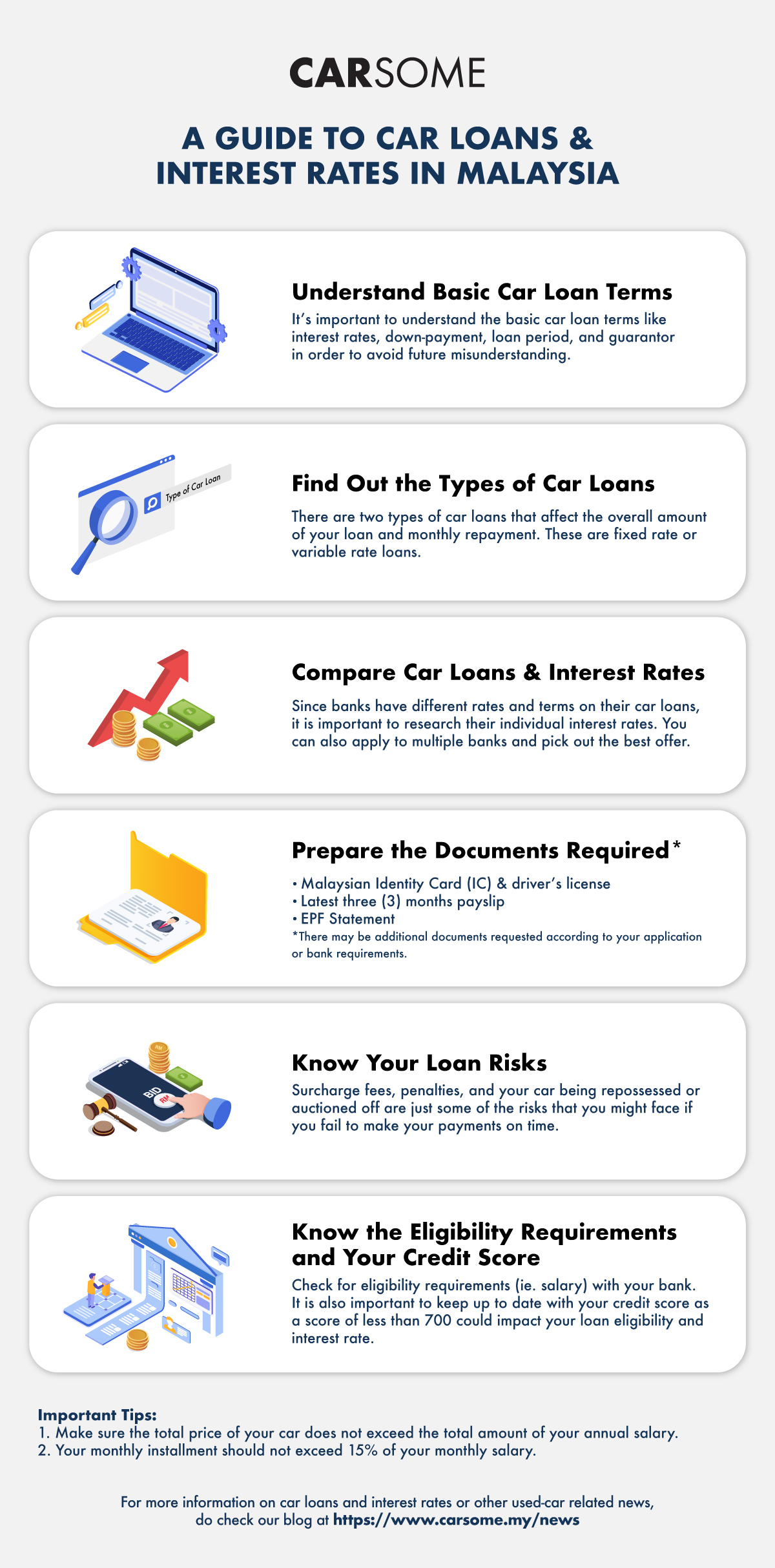

. When it comes to getting approved for car loans with decent terms a good credit score is key. To ensure you qualify for a car loan you have to be sure that you provide all the necessary documents for your application. Here is the procedure and steps or flow when you buy a new car in Malaysia.

To ensure you qualify for a car loan you have to be sure that you provide all the necessary documents for your application. For example to buy a car with a net worth of RM59993 the officer has a maximum loan eligibility of. You can repay when your subsequent paycheck is because of.

Generate principal interest and balance loan repayment table by year. Bank statements from the last 3 months. However some of the blacklisted government staff can apply the car loan.

The bank only provide 90 loan unless you are a government staff and university graduated person. Obtaining a Car Loan. Find a competitive interest rate for your hire-purchase from 18 banks in Malaysia.

This includes the likes of. As the name implies car loans in Malaysia is a category of loan taken by a borrower for the specific purpose of buying a car. Most banks provide hire purchase loans.

You may apply for a car loan by visiting any bank of your choice. Compare and calculate your monthly repayments on Loanstreets car loan calculator and save more than RM100 every month. Or you visit any Carsome Inspection Centers throughout Malaysia for free car inspection and evaluation assistance.

Blacklisted person usually cannot apply for any car loan from any bank. However if the owner is still repaying their car loan the vehicle registration card will be kept by their bank so ask for a bank certified photocopy of the registration card. If its RM55000 an approved loan is RM55000.

Most bank takes a few days to complete the process. If youve decided to allow your new car manufacturer or used car dealer to handle financing for you there isnt much to be done but fill in the requisite forms choose the tenure of the loan hire purchase loans typically allow 3-9 year tenures and submit these to the car agent along with the usual proof of income 3 months pay slips EPF StatementLHDN Statement and. By taking up a car loan the borrower is obligated to repay the loan amount plus interest to the lender ie.

A bank in instalments over a period of time. When you buy a car the. You can also use loan calculators to check the rates according to the price of the car down payment interest rate and salary.

How do I buy a car in Malaysia. Say you are looking to buy a Standard 2WD Proton X70. Below is a summarised diagram of a typical car loan application process in Malaysia.

Interest rate for a new car is. Once the application and documents are submitted it is up to the bank to decide on the approval of your car loan. You need at least RM2000 gross monthly salary for a car loan in Malaysia.

Aishah told The Malaysian Reserve TMR that the assessment used to take up to five days but now it could take up to a week or. Do note that this process can only go through if the sale value of your car is more than your balance loan. Enter down payment amount in Malaysian Ringgit.

When these are best financial option for emergencies borrow following browsing for. Once the application and documents are submitted it is up to the bank to decide on the approval of your car loan. The deposit payment of any car purchase is usually 10 of the total car price.

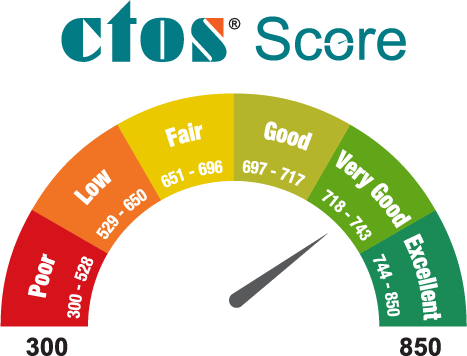

By taking up this loan this individual is tied down to a formal written agreement where the borrower car buyer is indebted to pay the loan amount plus interest to the lender banks financial agents etc over a specified period of time. To know how much the sale value of your car is you can visit any used car dealership to get an estimated amount. Established in 1990 CTOS is Malaysias leading Credit Reporting Agency CRA under the ambit of the Credit Reporting Agencies Act 2010.

Things you should know about hire purchase loans in Malaysia. Generate principal interest and balance loan repayment chart over loan period. So lets put some sense into what actually happens in the realm of car loans.

A car loan in Malaysia is a type of loan that is taken by an individual for the sole reason of buying a car. Enter car loan period in Years. Work permit if youre taking out a loan.

Enter loan interest rate in Percentage. Enter car price in Malaysian Ringgit. Payslips from the last 3 months.

If you are a first time car buyer this is usually classified as hire purchase loan. What actually happens when you buy a car in Malaysia and what are the things you will face. Shopping for a car loan for your new or used car.

Car loans commonly offer a maximum margin of financing of 90 hence you are expected to pay 10 of the car value to the dealership. Banks usually offer a maximum term of 9 years on the loan. Procedure To Appy Loan To Buy A Car.

Car Loan Application Process Malaysia Dollars Advance Eradicate Urgent Fiscal Anxieties Cash progress is a instrument of obtaining finance immediately within just the exact day for any emergency. How Long Car Loan Approval Malaysia. Be sure to take along all necessary documents which may differ from bank to bank to help speed up the application process.

Buying directly from the car owner is a similar process so ask for the PUSPAKOM B5 and B7 reports each cost RM30 and RM60 respectively. To lessen the amount of interest it is advised to pay a higher percentage upfront. Good FICO Scores range between 670 and 739 and a score of more than 739 is considered exceptional.

In Malaysia most commercial banks offer hire purchase loans. For further information about car. 14 rows How to calculate a car loan in Malaysia.

Below is a summarised diagram of a typical car loan application process in Malaysia. Ensure you have the proper documentation including. First of all you need to know how much your monthly and annual income is because this is one of the most basic eligibility requirements.

With the exception of boat or bike loans the loan amount should be rounded to the lower hundred ringgit amount. The process of applying for a car loan may be long-winded and put many people off but it is not actually that complicated.

Car Loan Eligibility Calculator Ctos Malaysia S Leading Credit Reporting Agency

The Malaysia Type Of Car Loan Proton April 2022 Tax Holiday Rebate Rm7000 Interest Rate As Low As 2 8

No comments for "Car Loan Process Malaysia"

Post a Comment